net investment income tax 2021 form

But in this case youll owe it on the 15000 MAGI overagesince its less than your net investment income. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS.

The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

. Printable 2021 federal tax forms are listed below along with their most commonly filed supporting IRS schedules worksheets 2021 tax tables and instructions for easy one page access. How is the NIIT Reported. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

Again youll owe the 38 tax. Income Thresholds for the 38 Net Investment Income Tax. Your wages and self-employment earnings by themselves have no impact on the NIIT.

California election to include net capital gain tax forms are a summary of California tax TAXABLE YEAR 2021 Investment Interest Expense Deduction CALIFORNIA FORM 3526 Attach to Form 540 Form 540NR or Form 541. Tax more commonly referred to as the net investment. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file.

Include state local and foreign income taxes you paid for the tax year that are attributable to net investment income You can determine the portion of your state local and foreign income taxes allocable to net investment income using any reasonable method. Attach to your tax return. The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US.

Income Tax Return for Estates and Trusts Schedule G Line 4. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or modified adjusted gross income. All About the Net Investment Income Tax.

If the amount on your 2021 Federal Form 10401040-SR1040NR line 18 is zero and the Net Investment Income Tax from line 17 202 1 Form 8960 is also zero STOP enter zero on Line 15 below. If an individual has income from investments the individual may be subject to net investment income tax. This form is to be included with the Form 1040 and Form 1041.

Attach Form 8960 to your return if your modified adjusted gross income MAGI is greater than the applicable threshold amount. Tax status NIIT Threshold Married Filing Jointly 250000 Head of Household 200000 Single 200000 Married Filing Separately 125000. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts.

If an individual owes the net investment income tax the individual must file form 8960 pdf. Department of the Treasury Internal Revenue Service 99 Net Investment Income Tax Individuals Estates and Trusts. April 8 2021 756 AM.

Per IRS Instructions for Form 8960 on page 1. According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. For most US individual tax payers your 2021 federal.

The Net Investment Income Tax. Use Form 8960 Net Investment Income TaxIndividuals Estates and Trusts to figure the amount of your Net Investment Income Tax NIIT. Single Head of Household.

Filing status Threshold Amount. Threshold amounts are not indexed for inflation. Royalties rental income and business income from activities that are treated as passive are also subject to the surtax.

Subject to a 38 unearned income Medicare contribution. Generally net investment income includes gross income from interest dividends annuities and royalties. Investment interest expense paid or accrued in 2021.

Future Developments For the latest information about developments related to Form 8960 and its instructions such as legislation. Printable 2021 federal income tax forms 1040 1040SR 1040SS 1040PR 1040NR 1040X instructions schedules and more. The Net Investment Income Tax shouldnt be an everyday or every year thing it applies to investment income above a fairly large threshold.

Since 2013 certain higher-income individuals have been. NIIT imposes a 38 surtax on income from investments. 2021 Instructions for Form 8960 Net Investment Income TaxIndividuals Estates and Trusts Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

Enter only the tax amount that is attributed to the net investment income. The tax only applies if you report net investment income. Taxpayers use this form to figure the amount of their net investment income tax NIIT.

See how much NIIT you owe by completing Form 8960. The tax applies to. The total of the state local and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960.

4 2021 the court held that the US. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Lets say you have 30000 in net investment income but your MAGI only goes over the threshold by 15000.

Updated for tax year 2021 october 16 2021 0235 am. The net investment income tax is reported on Form 8960. The statutory authority for the tax is.

The niit is a 38 additional tax on the lesser of net investment income or the excess of the childs modified adjusted gross income magi over a threshold amount. Investments includes portfolio income items such as interest dividends and short-term and long-term capital gains. We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021.

Net Investment Income Tax. Names as shown on tax return. SSN ITIN or FEIN.

You can download or print current or past-year PDFs of Form 8960 directly from TaxFormFinder. The 38 Net Investment Income Tax. You can print other Federal tax forms here.

Do not include sales tax or any foreign income taxes paid for which you took a credit. For instructions and the latest information. Married Filing Jointly Qualifying Surviving Spouse with Dependent Child.

Tax Treaty with France did not change the general rule that the foreign tax credit cannot offset the NIIT.

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

What Is The The Net Investment Income Tax Niit Forbes Advisor

What Is Investment Income Definition Types And Tax Treatments

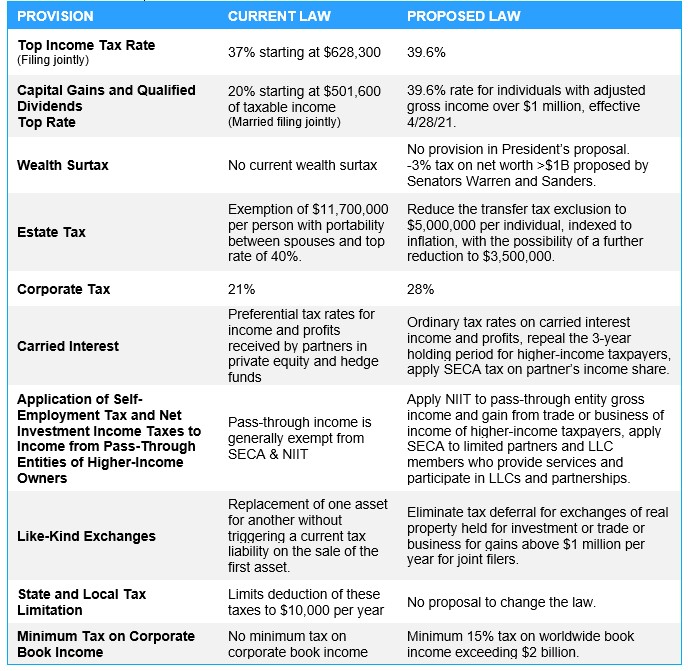

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

You Have To File A Tax Return If You Either Owe Tax Or You Re Owed A Refund For Overpaid Taxes Canada Small Business Tax Business Tax Business Tax Deductions

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Tfsa Guide 2021 Investing Financial Advice Tax Free Savings

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

2021 2022 Income Tax Calculator Canada Wowa Ca

H R Block Review 2021 Overview Pricing And Features Who It S For Hr Block Tax Software Investing

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

What Are The Terms Used In Share Market Experts And Amateurs Use These Terms Frequently To Explain Trading Strategi Share Market Income Tax Trading Strategies

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Minimalist Excel Template For Rental Property Buying Etsy In 2022 Excel Templates Templates Rental